How to do accounting for factored invoices?

Accounting for factored invoices in a trucking company involves recording the financial transactions related to the process of factoring. Factoring is when a company sells its accounts receivable (invoices) to a third party, known as a factor, to receive immediate cash. Here’s a step-by-step guide on how to handle factored invoices in the accounting process:

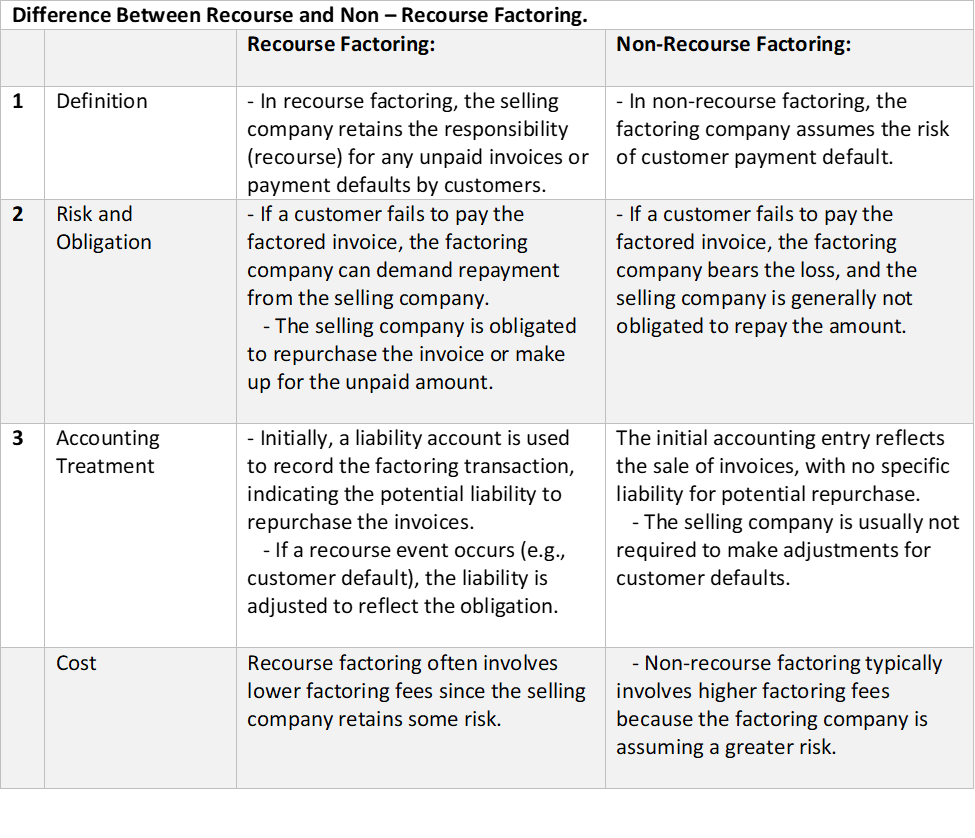

What is difference between Recourse and Non – Recourse Factoring?

How to do accounting for Without Recourse Factoring?

Initial Factoring:

– Record the Sale of Invoices:

– Debit: Cash or Bank Account

– Credit: Factoring Revenue

This entry reflects the immediate cash received from the factoring company without any obligation to repurchase the invoices.

Ongoing Monitoring:

– Regularly reconcile your accounting records with the factoring company’s statements to ensure accuracy.

How to do accounting for Recourse Factoring?

Initial Factoring:

– Record the Sale of Invoices:

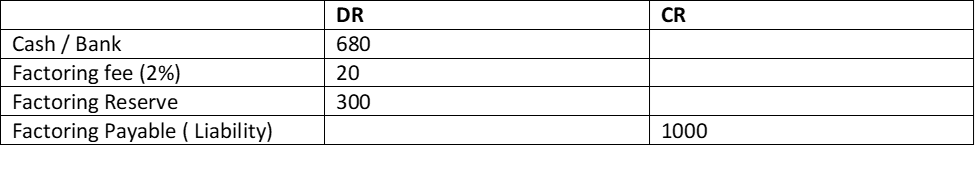

Let’s Assume Mr. A sell an invoice of $1000 to a factoring company and factoring company charge 2% as factoring fee and reserve 20 % than following entry needs to be recorded.

This entry reflects the immediate cash received. However, since the company has recourse, a liability account is used to recognize the potential obligation to repurchase the invoices.

*Note: Record factoring liability equivalent to invoice amount.

Recourse Event (Buyback):

– If a Customer Defaults: In case of Recourse factoring Mr. A is responsible to collect the invoices so if customer is not paying factoring company will send back this to trucking company. Record the following transaction if customer default.

This entry reflects the obligation to repurchase the invoice due to the customer’s default. This entry cancels the initial factoring entry and reinstates the accounts receivable.

4. Monitor Collections:

Keep track of customer payments. When a customer pays the factored invoice:

– Debit: Cash or Bank Account

– Credit: Accounts Receivable

| DR | CR | |

| Cash / Bank | 1000 | |

| Accounts Receivable | 1000 | |

| Accounting Hunter – Your Outsourced Bookkeeping Partner | ||

This entry reflects the reduction in accounts receivable due to customer payment.

5. Reconcile with Factoring Statements:

Regularly reconcile your accounting records with the factoring company’s statements to ensure accuracy. Verify that the amounts, fees, and payments match.

6. Report Financial Statements:

Ensure that your financial statements accurately reflect the factored invoices, cash received, and associated expenses. This information is crucial for decision-making and financial analysis.

7. Tax Implications:

Understand the tax implications of factoring. Consult with a tax professional to ensure compliance and proper accounting for taxes related to factoring transactions.

8. Maintain Documentation:

Keep detailed records of factoring agreements, contracts, and communications with the factoring company. This documentation is essential for audits and financial transparency.

It’s advisable to work closely with your accountant or financial advisor to tailor these steps to the specific circumstances of your trucking company and to ensure compliance with accounting standards and regulations.

Why Choose Accounting Hunter for Trucking Bookkeeping?

- Industry Expertise: We specialize in trucking bookkeeping, ensuring that your financial records are managed with a deep understanding of the unique challenges and requirements of the trucking industry.

- Compliance Assurance: Our team stays up-to-date with the latest tax regulations and industry-specific compliance standards, helping your business avoid penalties and ensuring accurate reporting.

- Cost Reduction: We aim to reduce your operational costs by streamlining financial processes and identifying areas for savings, often cutting costs by 10–30%.

- Efficient Accounts Management: From accounts receivable to collections, we handle your financial tasks efficiently, freeing you to focus on growing your trucking business.

- Automation and Technology: We integrate advanced accounting tools to automate your bookkeeping, reducing errors and saving you time.

- Customized Solutions: We tailor our services to meet the specific needs of trucking businesses, whether you’re an owner-operator or managing a fleet.

- Growth Support: Our insights help you make data-driven decisions, supporting your business’s growth and sustainability.

- Reliable and Responsive: With Accounting Hunter, you get a dedicated team that values your time, delivers on commitments, and ensures your financial records are always up-to-date.

Let Accounting Hunter drive your trucking business toward financial success!